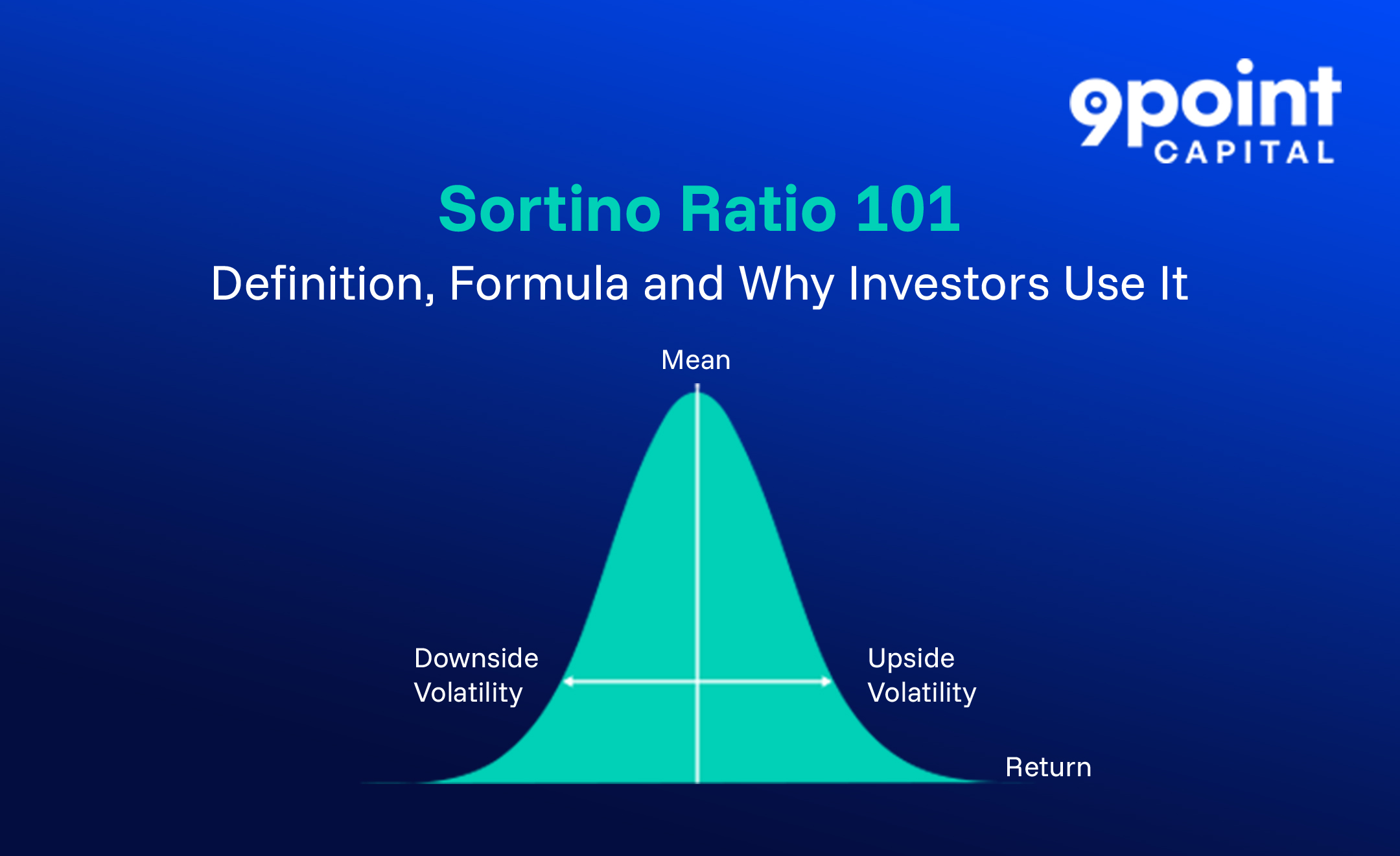

The truth is: volatility in your investment portfolio isn’t necessarily a red flag. Some volatility can work in your favour if you know how to read it.

In this guide, we’ll break down:

- The difference between constructive (“good”) and destructive (“bad”) volatility

- How to spot each one in your holdings?

- What does it mean for long‑term financial health?

- Real‑world case studies to drive the point home.

Let’s decode the myth around volatility, the silent heartbeat of the markets.

What is Volatility?

Volatility measures how far (and how fast) a price moves over time.

- Standard deviation gauges the dispersion of returns.

- Beta shows how much an asset co‑moves with a benchmark (it’s correlation‑plus‑volatility, not volatility alone).

Volatility is often treated as “risk,” but that’s only half the story.

Good Volatility vs Bad Volatility: The Core Difference

Here are the major differences between good volatility and bad volatility:

| Feature | Constructive (Good Volatility) | Destructive (Bad Volatility) |

| Typical Direction | Frequent upward bursts, healthy pullbacks | Wild, unpredictable drops |

| Underlying Driver | Innovation, earnings beats, business expansion | Fraud, weak balance sheet, over‑leverage |

| Example | Early‑stage AI stocks; Bitcoin’s decade‑long uptrend | Penny‑stock pump‑and‑dumps; Yes Bank in 2020 |

| Likely Outcome | Outsized long‑term returns | Capital erosion or permanent loss |

| Investor Playbook | Long horizon, dollar‑cost averaging (DCA), risk‑adjusted sizing | Tight exit rules, position review, possible avoidance |

Why Good Volatility Matters

Good volatility is an opportunity in disguise. It typically comes with:

- Innovative sectors: Think of AI, clean energy, or digital assets like Bitcoin.

- Emerging market stocks: Where growth is fast but uneven.

- Early-stage investments: Volatile in the short term, but promising in long-term trajectories.

Case in point: Between 2014‑2024, Bitcoin logged annualised volatility of roughly 60 – 80 % and still compounded ≈ 80 – 85 % per year over the same window. Patience plus position‑sizing turned turbulence into alpha.

Bad Volatility – A Sign to Rethink

Bad volatility is like a smoke alarm. It signals:

- Weak fundamentals (declining revenue, bad debt).

- Over-leveraged companies.

- External shocks (regulatory, legal, macroeconomic).

Case study: Yes Bank, 2020 – Shares crashed 56 % in a single session after the RBI imposed a moratorium, triggered by mounting non‑performing loans and governance issues. Here, volatility signalled deteriorating fundamentals rather than opportunity.

Key Indicators to Spot the Type of Volatility

Here are the significant hints to spot the types of volality in your portfolio:

| Indicator | Constructive Hint | Destructive Hint |

| Earnings | Repeat beats, positive guidance | Sudden misses, negative revisions |

| News Flow | Sector tailwinds, funding rounds | Regulatory raids, fraud probes |

| Price Chart | Stair‑step uptrend with normal pullbacks | Vertical spikes followed by cliffs |

| Beta | > 1 is fine if sector‑wide; dangerous when only one stock is surging or collapsing |

Volatility and Time Horizon

The shorter your investment horizon, the more volatility feels like risk.

But over time:

- Good volatility smooths out,

- Poor assets get filtered out,

- Compounding takes over.

Example: Nifty 50 suffered multiple 10 %+ drawdowns, yet still posted ≈ 11 % CAGR over the last 15 years (total‑return basis). Time reframed the noise.

Ways to Harness Good Volatility

- Dollar-Cost Averaging (DCA)

Spread your investment over time to average out the market’s up and down swings. - Diversification

Spread across asset classes, equity, fixed income, and digital assets, for a balanced exposure. - Rebalancing

Every 6-12 months, rebalance your portfolio to avoid overexposure to volatile performers. - Long-Term Mindset

Use volatility as an entry point, not an exit trigger. - Risk-Adjusted Allocation

Allocate more to stable assets and smaller portions to high-growth, volatile plays.

Common Misconceptions Around Volatility

Myth 1: “Volatility means I’m losing money.”

→ Fact: A price dip isn’t a loss until you sell.

Myth 2: “Stable means safe.”

→ Fact: Low volatility can also mean low return (e.g., fixed deposits).

Myth 3: “Avoid volatile assets completely.”

→ Fact: Many of history’s biggest wealth creators, early tech stocks, Bitcoin ETFs, were highly volatile at inception.

Wrapping Up

Understanding the nature of volatility in your portfolio is more important than fearing it. With the right tools, mindset, and discipline, you can make volatility work for you, not against you.

Remember: It’s not the volatility that hurts. It’s how you react to it. Keep an eye on the volatility in your investment portfolio, not to avoid it, but to manage it smartly. Smart investors don’t fear volatility; they harness it.

Stay informed with curated insights and expert analysis