A US stock portfolio allows you to diversify beyond domestic markets, tap into innovative companies and potentially achieve long-term wealth growth. The most efficient way to do this is through Exchange Traded Funds (ETFs).

At 9Point Capital, we believe ETFs are one of the smartest tools for investors seeking seamless access to global markets, especially the US

Why Choose ETFs for Your US Stock Portfolio?

Building a US stock portfolio directly by purchasing individual stocks can be expensive, time-consuming and requires extensive research. ETFs simplify the process by offering:

- Diversification: Exposure to hundreds of US companies in one instrument.

- Lower Costs: ETFs typically have lower expense ratios compared to mutual funds.

- Accessibility: You can start with small amounts, unlike buying high-priced stocks like Amazon or Alphabet directly.

- Liquidity: ETFs trade like stocks on exchanges, making them easy to buy or sell anytime.

This makes them especially valuable for Indian investors who want international diversification through regulated structures such as those facilitated by platforms like 9Point Capital.

Steps to Build a US Stock Portfolio With ETFs

Here are the significant steps you can take to build a US stock portfolio with ETFs:

1. Define Your Investment Goals

Are you aiming for growth, income, or balanced returns? Growth-oriented investors may choose ETFs tracking the Nasdaq-100, while income seekers may prefer dividend ETFs.

2. Choose the Right ETF Categories

Some popular categories include:

- Broad Market ETFs: Like SPDR S&P 500 ETF (SPY) for overall US exposure.

- Sector ETFs: Technology (XLK), Healthcare (XLV), Financials (XLF).

- Thematic ETFs: Innovation, AI, clean energy, or blockchain.

- Dividend ETFs: For steady cash flows, e.g., Vanguard Dividend Appreciation ETF (VIG).

3. Diversify Across Multiple ETFs

Avoid putting all your money into a single fund. Spread your US stock portfolio across broad-based, sectoral and thematic ETFs to balance risk.

4. Consider Costs and Taxes

- Expense Ratios: Compare between providers (Vanguard, BlackRock, State Street).

- Brokerage & Remittance Charges: Especially important for Indian investors using LRS (Liberalised Remittance Scheme).

- Taxation: US dividends are subject to withholding tax (~25–30%).

Investors working with 9Point Capital get structured guidance on LRS, taxation and compliance to ensure smooth cross-border investing.

5. Monitor and Rebalance

Once your US stock portfolio is built, track performance regularly. Rebalance annually or when asset allocation drifts significantly.

How Indian Investors Can Start Practically

For Indian investors, here’s the typical journey:

- Open an Account With a Regulated Platform – Instead of unverified overseas brokers, it’s better to go via a trusted, SEBI-regulated platform like 9Point Capital, which provides global market access through LRS-compliant structures.

- Remit Funds Abroad via LRS – Up to $250,000 annually per individual is allowed under RBI rules. Platforms like 9Point Capital help streamline this process.

- Complete KYC and Compliance Checks – PAN, A2 form and source of funds are mandatory.

- Select ETFs and Allocate Capital – Based on your goals and advisor’s guidance, you can diversify between S&P 500, Nasdaq-100, dividends and sectoral ETFs.

- Track and Rebalance – Review performance quarterly, realign annually.

Performance Proof: Why US ETFs Make Sense

- The S&P 500 has delivered ~10.5% CAGR over the last 30 years, outpacing most global indices.

- The Nasdaq-100 has grown at ~14% CAGR in the same period, powered by tech giants.

- By comparison, the Nifty 50 has grown ~11–12% CAGR over 20 years, but with higher volatility and lower sectoral diversification.

Adding US exposure through ETFs ensures your portfolio benefits from global innovation and resilience.

Example ETF Allocation (Balanced Investor)

- 50% in S&P 500 ETF (broad exposure)

- 20% in Nasdaq-100 ETF (growth tilt)

- 15% in Dividend ETF (stability)

- 15% in Sector/Thematic ETF (higher risk, higher reward)

This mix provides broad diversification while keeping growth potential intact.

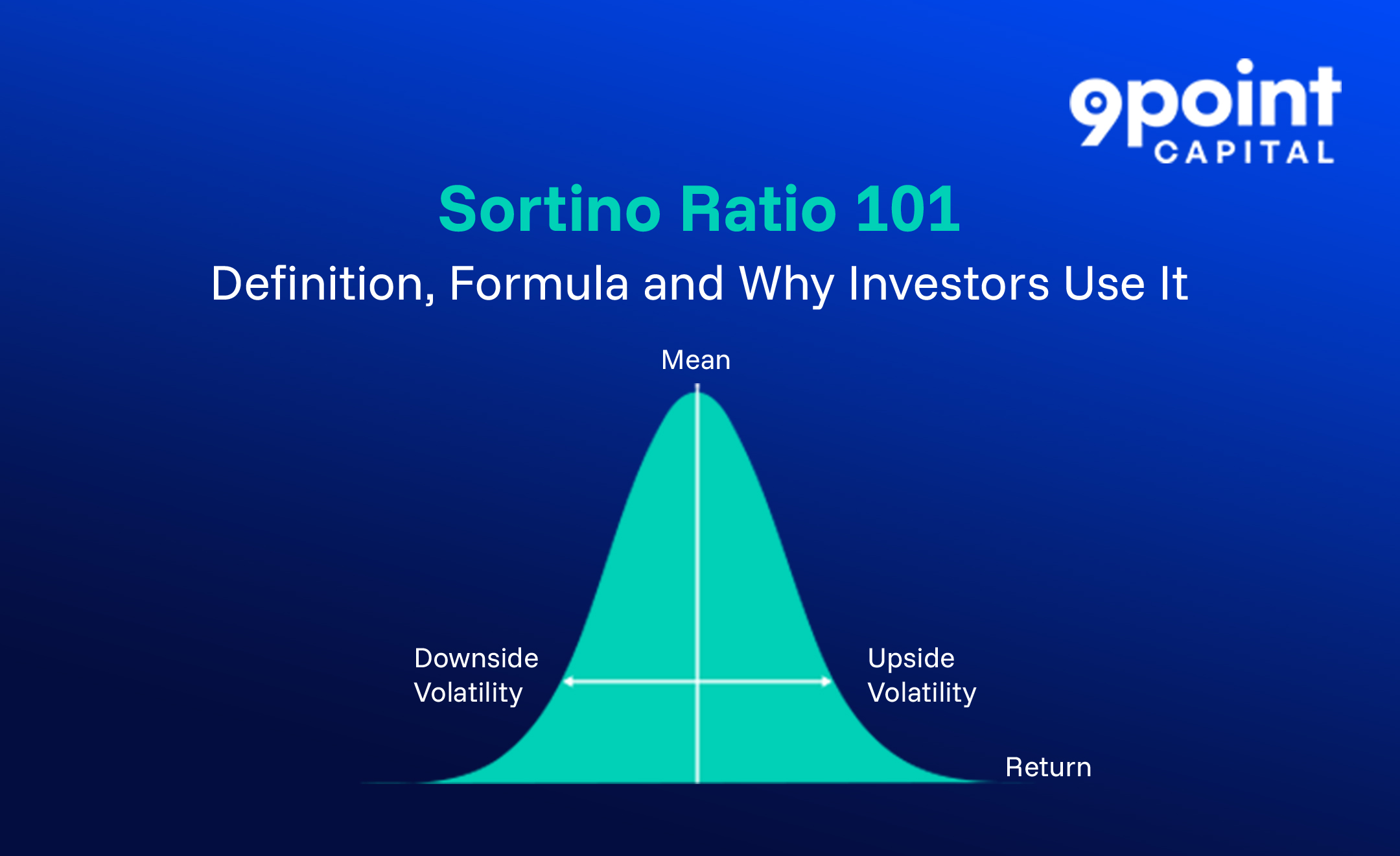

Key Risks to Keep in Mind

- Currency Risk: Rupee depreciation against the US Dollar impacts returns.

- Market Volatility: US stocks are subject to global macroeconomic swings.

- Thematic Overexposure: Too much allocation to niche ETFs can increase risk.

- Regulatory Complexity: Using unregulated overseas brokers can expose you to compliance issues. Platforms like 9Point Capital mitigate this with fully compliant structures.

In Summary

A thoughtfully designed US stock portfolio with ETFs gives investors the best of both worlds: the stability of broad US markets and the growth of innovative sectors. Beyond returns, it provides currency diversification, global exposure, and protection against domestic market slowdowns.

For Indian investors, partnering with a trusted, regulated platform like 9Point Capital ensures that every step – from remittance to compliance to portfolio construction is handled seamlessly, allowing you to focus on long-term wealth creation.

FAQs on Building a US Stock Portfolio

1. Can I invest in a US stock portfolio from India?

Yes, under the RBI’s Liberalised Remittance Scheme (LRS), Indian residents can invest up to $250,000 per financial year in overseas assets, including ETFs. 9Point Capital helps streamline this process for HNIs and professional investors.

2. Which is better – buying US stocks directly or ETFs?

ETFs are generally better for beginners as they provide diversification and lower costs. Direct stock picking is suited for experienced investors.

3. What are the tax implications?

Dividends are taxed at ~25% withholding in the US and must be declared in the Indian ITR (with DTAA relief). Capital gains are taxed as per Indian laws.

4. How much should I allocate to a US stock portfolio?

A typical allocation ranges between 10–25% of your overall investments, depending on your risk tolerance and financial goals.

5. Which ETFs are popular among Indian investors?

SPDR S&P 500 (SPY), Invesco QQQ (Nasdaq-100) and Vanguard Dividend Appreciation (VIG) are widely chosen for diversified exposure.