This guide breaks down capital gains taxation, dividend tax, compliance requirements and strategies to optimise tax efficiency under Indian and U.S. tax laws.

1. Taxation on Capital Gains

When an Indian resident sells U.S. stocks, the tax treatment depends on the holding period:

a. Short-Term Capital Gains (STCG)

- If held for less than 24 months, gains are classified as short-term capital gains.

- Taxed as per the investor’s income tax slab in India.

- No capital gains tax is levied in the U.S. for Indian investors.

b. Long-Term Capital Gains (LTCG)

- If held for 24 months or more, gains are categorised as long-term capital gains.

- Taxed at 12.5% under Indian tax laws.

- No capital gains tax in the U.S. for non-resident Indians (NRIs).

2. Taxation on Dividends

Dividends from U.S. stocks are taxed in both the U.S. and India:

a. Withholding Tax in the U.S.

- The U.S. government imposes a flat 25% withholding tax on dividends for Indian investors.

For example:

- You earn $100 in dividends

- America takes $25 (25%)

- You bring $75 to India

- If your Indian tax rate is 30%, instead of paying $30 on the full $100, you can subtract the $25 you already paid to America, so you only pay $5 more to India.

b. Taxation in India

- Dividends from foreign stocks are taxable in India as per the investor’s income tax slab.

- However, DTAA tax credits can be claimed to avoid double taxation.

- Indian investors can deduct the U.S. tax paid (up to 25%) from their Indian tax liability.

3. Tax Reporting & Compliance Requirements

Proper tax reporting and compliance are crucial when investing in U.S. stocks. Non-compliance can lead to penalties under Indian tax laws.

a. Liberalised Remittance Scheme (LRS) Compliance

- Investments in U.S. stocks must be made under the Liberalised Remittance Scheme (LRS).

- Annual remittance limit: $250,000 per financial year.

- A 5% TCS (Tax Collected at Source) applies on remittances exceeding ₹7 lakh per financial year (Limit is Rs.10 lakhs from FY 2025-26).

b. Disclosure in Income Tax Returns (ITR)

- Foreign assets and income must be disclosed under Schedule FA of ITR.

- Non-disclosure can attract penalties under the Black Money (Undisclosed Foreign Income and Assets) Act, 2015.

c. FEMA Regulations

- Investors must comply with Foreign Exchange Management Act (FEMA) regulations while investing abroad.

- Non-compliance can lead to penalties and restrictions on future investments.

4. Double Taxation Avoidance Agreement (DTAA) Benefits

The India-U.S. DTAA ensures that Indian investors do not pay taxes twice on the same income. Leveraging this agreement effectively can significantly reduce tax burdens.

- Investors can claim a tax credit on dividend income already taxed in the U.S.

- To claim DTAA benefits, investors must file Form 67 in India.

5. Estate Tax Considerations

U.S. estate tax laws apply to foreign investors holding assets in the U.S. Planning ahead can help mitigate potential tax liabilities.

- The U.S. imposes an estate tax on foreign investors’ assets held in the U.S.

- If the total U.S. asset value exceeds $60,000, an estate tax of up to 40% may be levied.

- Indian investors should consider estate planning strategies, such as holding assets through an entity, to mitigate estate tax risk.

6. How to Optimise Tax Efficiency?

Tax optimisation strategies can help investors maximise their returns while ensuring compliance with Indian and U.S. tax laws.

a. Choose Tax-Efficient Investment Structures

- Investing through a GIFT City entity may provide better tax optimisation for HNIs and UHNIs.

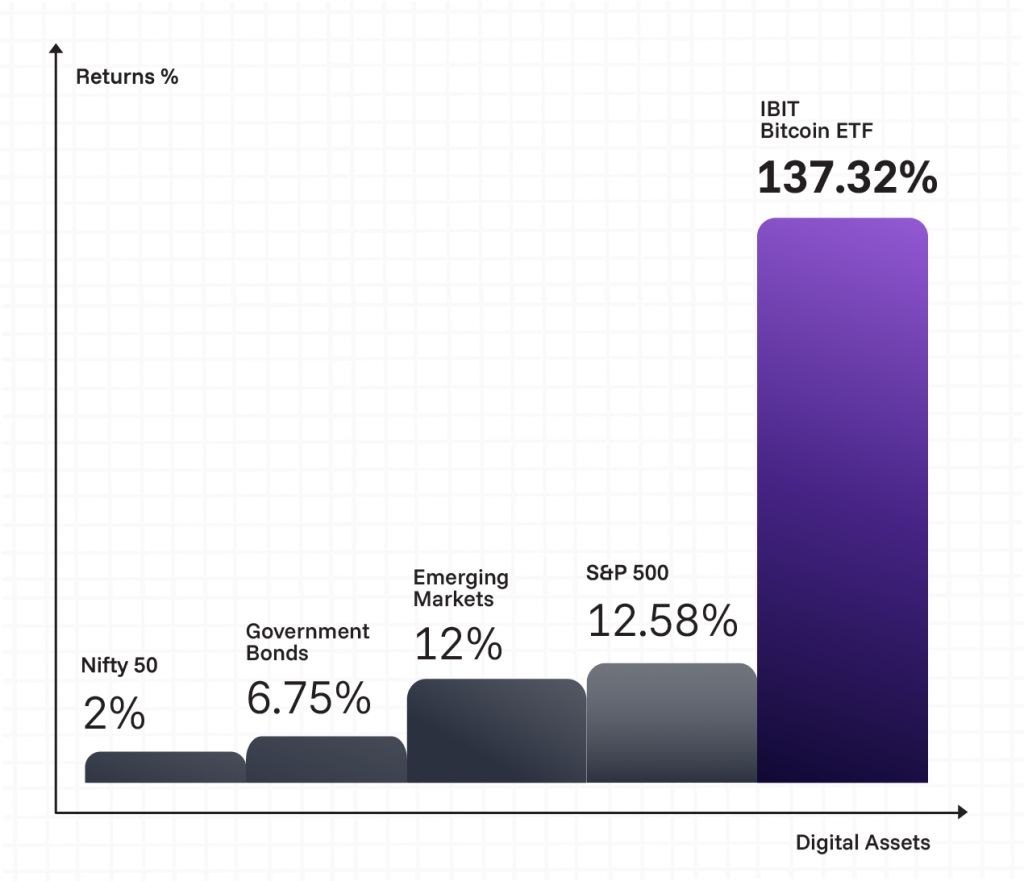

- ETFs may offer better tax benefits compared to direct stock dividends.

b. Use DTAA Effectively

- Always declare foreign tax paid to avoid double taxation.

c. Consult a Tax Advisor

- Given the complexity of global taxation, professional tax planning helps structure investments for maximum efficiency.

7. How 9Point Capital Can Help

Understanding tax-efficient international investments can be complex. 9Point Capital specialises in structured investments for Indian investors, helping them optimise tax efficiency and compliance when investing in U.S. stocks and ETFs.

Through strategic investments and expert guidance, we help investors navigate taxation while maximising returns.

Conclusion

Investing in U.S. stocks is a powerful way for Indian investors to diversify globally, but taxation must be carefully managed. Capital gains are taxed only in India, while dividends face double taxation unless DTAA benefits are claimed. Proper tax planning ensures compliance and efficiency.