But what exactly are US equities for Indian investors and how can they participate in them legally, efficiently and profitably?

What Are US Equities?

US equities refer to shares of publicly traded companies listed on American stock exchanges such as:

- New York Stock Exchange (NYSE): Known for blue-chip companies like Coca-Cola, Johnson & Johnson and Berkshire Hathaway.

- NASDAQ: A tech-focused exchange home to giants like Apple, Microsoft, Amazon, Meta and Alphabet (Google).

Owning US equities means holding a piece of businesses that drive the global economy.

Why Indian Investors Should Consider US Equities?

Here are major reasons why Indian investors should diversify their portfolios and invest in US equities:

1. Access to Global Leaders

Invest in dominant global sectors like technology, healthcare and finance through household names and world-changing innovation.

2. Geographic Diversification

Avoid overexposure to domestic risks. Adding US equities helps balance your portfolio across economies.

3. Dollar-Denominated Wealth Creation

Gain exposure to the world’s reserve currency, the US dollar, which also acts as a natural hedge against INR depreciation.

4. Participation in Innovation

Access cutting-edge industries such as artificial intelligence, electric vehicles, cloud computing, biotech and semiconductors.

5. Regulated, Transparent Markets

US markets are governed by the Securities and Exchange Commission (SEC), ensuring compliance, disclosures and investor protection.

How Can Indian Investors Access US Equities?

Indian residents can invest abroad under the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India, which allows up to USD 250,000 remittance per financial year.

Option 1: Direct Stock Investing

Open an international brokerage account and invest in individual stocks like Tesla or Google.

However:

- Requires time for research

- Higher volatility

- Individual stock risk

- Involves currency conversion costs

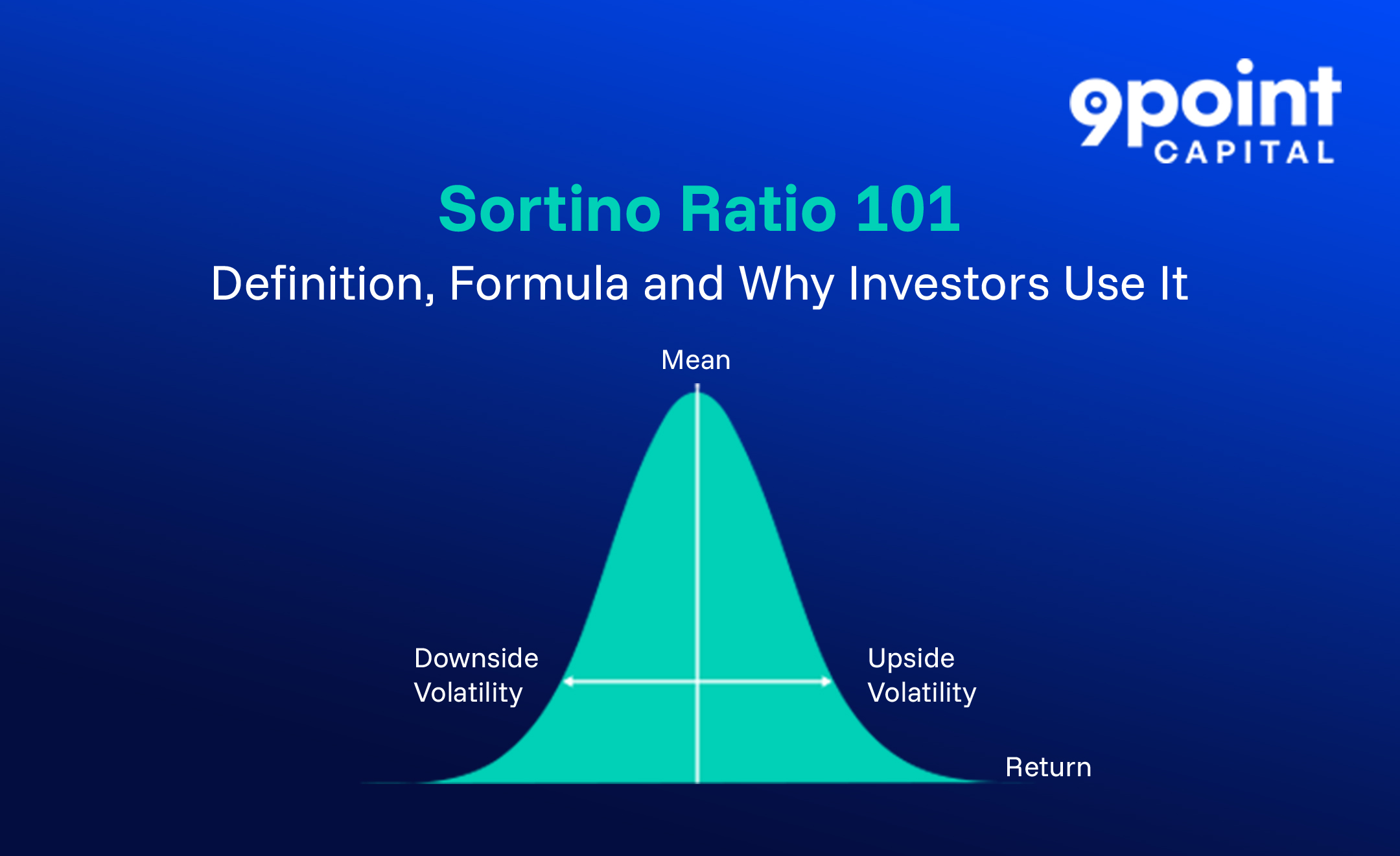

Option 2: US Equity ETFs (Recommended for Beginners)

Exchange-Traded Funds are baskets of US stocks, like the S&P 500 or Nasdaq-100, that trade like shares.

Benefits of ETFs:

- Instant diversification

- Lower fees

- Easy execution

- Simpler compliance under LRS

US equities for Indian investors are often best accessed through ETFs due to ease of implementation and broad exposure.

Important Things Every Indian Investor Must Know

Here are the most significant aspects every Indian investors should keep in mind before investing US equities:

1. U.S. Market Timings (IST)

US markets operate from 7:00 PM to 1:30 AM IST (during Daylight Savings). If you’re a direct investor, you’ll need to track price movements during Indian night hours.

2. Dividend Taxation Under DTAA

Dividends from US stocks are subject to a 25% withholding tax. As per the India-US Double Taxation Avoidance Agreement, you can claim a foreign tax credit in your Indian income tax return.

3. TCS on Remittance

As per updated LRS norms:

- No Tax Collected at Source (TCS) applies on remittances up to ₹10 lakh per year

- This amount is adjustable against your total income tax liability during filing

4. Currency Exchange Costs

When investing abroad, monitor:

- INR to USD exchange rates

- Wire transfer charges

- Platform and conversion fees

These factors can impact your net investment value and overall returns.

5. Repatriation Rules

Bringing back capital gains or dividends to India is allowed under LRS but must be declared properly in your income tax return.

US equities for Indian investors also require an understanding of these regulations to ensure compliance and optimal outcomes.

Who Should Consider US Equities?

- Long-term investors seeking global exposure

- HNIs looking to hedge INR currency risk

- Parents planning for overseas education or dollar needs

- Investors aiming for innovation-based growth themes

US equities for Indian investors are particularly well-suited for those looking to diversify beyond domestic markets while accessing mature and regulated ecosystems.

How 9Point Capital Helps You Invest in US Equities?

We simplify US equities for Indian investors through a secure, regulated and advisory-led platform.

Our services include:

- Curated ETF portfolios across US sectors and themes

- Seamless LRS-compliant execution and remittance support

- Tax-optimised investment structures via GIFT City

- Safe custody through SIPC-insured US custodians

- Portfolio advisory, rebalancing and real-time performance tracking

Whether you’re starting small or allocating strategically, 9Point Capital ensures your US equities journey is smooth and compliant.

Final Thoughts

As markets become more interconnected, Indian investors must think beyond borders. With the right platform, process and partner, investing in US equities for Indian investors can be secure, compliant and rewarding.

If you’re ready to explore new opportunities, it’s time to think globally and invest smartly.

Discover how 9Point Capital can help you invest in US equities today.