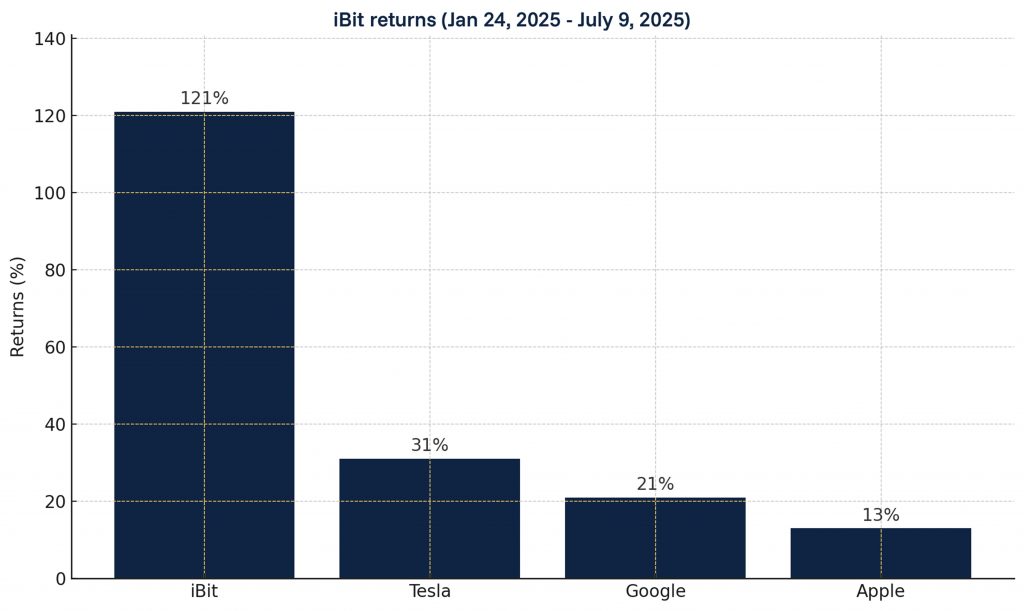

Since January 2025, the iBit Bitcoin ETF has delivered a staggering 121% return, leaving tech giants like Tesla (31%), Google (21%) and Apple (13%) far behind. This kind of performance has brought back the big question – Bitcoin ETFs vs blue chips: which offers better long-term value, growth potential and portfolio relevance in a fast-changing market?

Bitcoin ETFs in 2025: The Rise of iBit

iBit represents a new generation of Bitcoin ETFs, regulated, transparent and accessible to mainstream investors. Unlike speculative avenues, ETFs like iBit offer exposure to Bitcoin with institutional-grade custody, simplified compliance and SIPC-backed protection.

Within just over five months, iBit’s 121% return has outperformed even the best-known blue chips in the market.

For investors looking to enter the digital asset space through regulated channels, licensed platforms like 9Point Capital provide curated access to top-performing ETFs that align with long-term wealth creation goals.

Why Bitcoin ETFs Outperformed Blue Chips in 2025

Here’s why Bitcoin ETFs like iBit are now firmly in the spotlight:

1. Regulatory Backing

In 2024, the U.S. approved several spot Bitcoin ETFs. This made them fully regulated and safe for institutions and retail investors. Indian investors can now access these through trusted platforms under the RBI’s LRS rules.

2. Lower Investment Size

Buying 1 Bitcoin costs $100,000 (around ₹83 lakhs). But with Bitcoin ETFs, you can start small, from just ₹5,000 onwards, just like investing in a regular stock.

3. Superior Returns in 2025

In the first 6 months of 2025:

- iBit Bitcoin ETF returned 121% ( for example: ₹10 lakhs became ₹22.1 lakhs)

- Tesla gave ~31% (₹13.1 lakhs)

- Google ~21% (₹12.1 lakhs)

- Apple ~13% (₹11.3 lakhs)

Bitcoin ETFs are leading the race in 2025.

4. Ease of Participation

No wallets, no private keys. With a brokerage-linked Bitcoin ETF, the exposure is as simple as buying a stock.

5. The Maturity of Digital Assets

Bitcoin’s evolution from speculation to store-of-value is no longer theory; it’s playing out in real-time. The Bitcoin ETFs vs Blue Chips debate reflects a growing acceptance of this shift.

How to Build Smart Portfolios?

This is not about replacing blue chips; it’s about rebalancing portfolios to include digital assets in a regulated and efficient way.

The comparison of Bitcoin ETFs vs Blue Chips is no longer theoretical. With clear data like iBit’s performance, it’s becoming a practical discussion for forward-looking investors.

Tesla, Google and Apple still represent innovation and resilience. But a well-rounded portfolio in 2025 must include both tried-and-tested stocks and future-forward digital assets.

As India’s first digital asset management firm, 9Point Capital empowers investors to diversify across regulated global ETFs, including Bitcoin ETFs like iBit, within tax-efficient, compliant frameworks under LRS and GIFT City.

Final Word: Why Balanced Portfolios Are Winning in 2025

2025 has proven that Bitcoin ETFs are leading the scoreboard. With iBit clocking triple-digit returns in under six months, investors can no longer ignore this high-performing asset class.

The Bitcoin ETFs vs Blue Chips debate is about recognising that the world of investing is expanding. Blue chips bring resilience. Bitcoin ETFs bring exponential potential. The smartest portfolios of the future will be those that blend both.

If you’re ready to build a forward-looking portfolio, 9Point Capital is here to help you do it securely, strategically and globally.