At 9Point Capital, we believe modern investors don’t just need access, they need clarity, conviction and a robust framework. Passive investing alone no longer meets the needs of those planning for generational wealth, retirement planning, or alpha growth.

This is where professionally managed portfolios like those offered by experts at 9Point Capital step in. With the rise of sophisticated Portfolio Management Services (PMS) in India, investors now have access to advanced, quant-based digital asset management strategies, providing exposure to global equities, digital asset products including Bitcoin ETFs and curated thematic baskets.

Smart PMS structuring isn’t just about seeking alpha returns—it’s about aligning your capital with a vision, managing risk intelligently and unlocking long-term growth through focused execution. Today’s forward-thinking investors should invest in PMS services, considering the rising global headwinds and the financial necessity standpoint.

Define the purpose. Align the strategy. Achieve the outcome.

Every successful portfolio begins with clarity of purpose. Whether your objective is wealth preservation, retirement planning, or multi-generational legacy planning, the foundation of smart investing lies in defining what success looks like for you.

At 9Point Capital, we tailor each PMS strategy to reflect your investment horizon, return expectations and risk profile. Strategy matters even more for new-age portfolios that include digital assets, ETFs, and global equities. These instruments require not just access, but informed, research-backed selection and constant oversight.

Purpose-driven portfolios are never accidental. With disciplined execution and thematic precision, they become long-term engines of wealth creation.

Focused Diversification: The Power of Precision

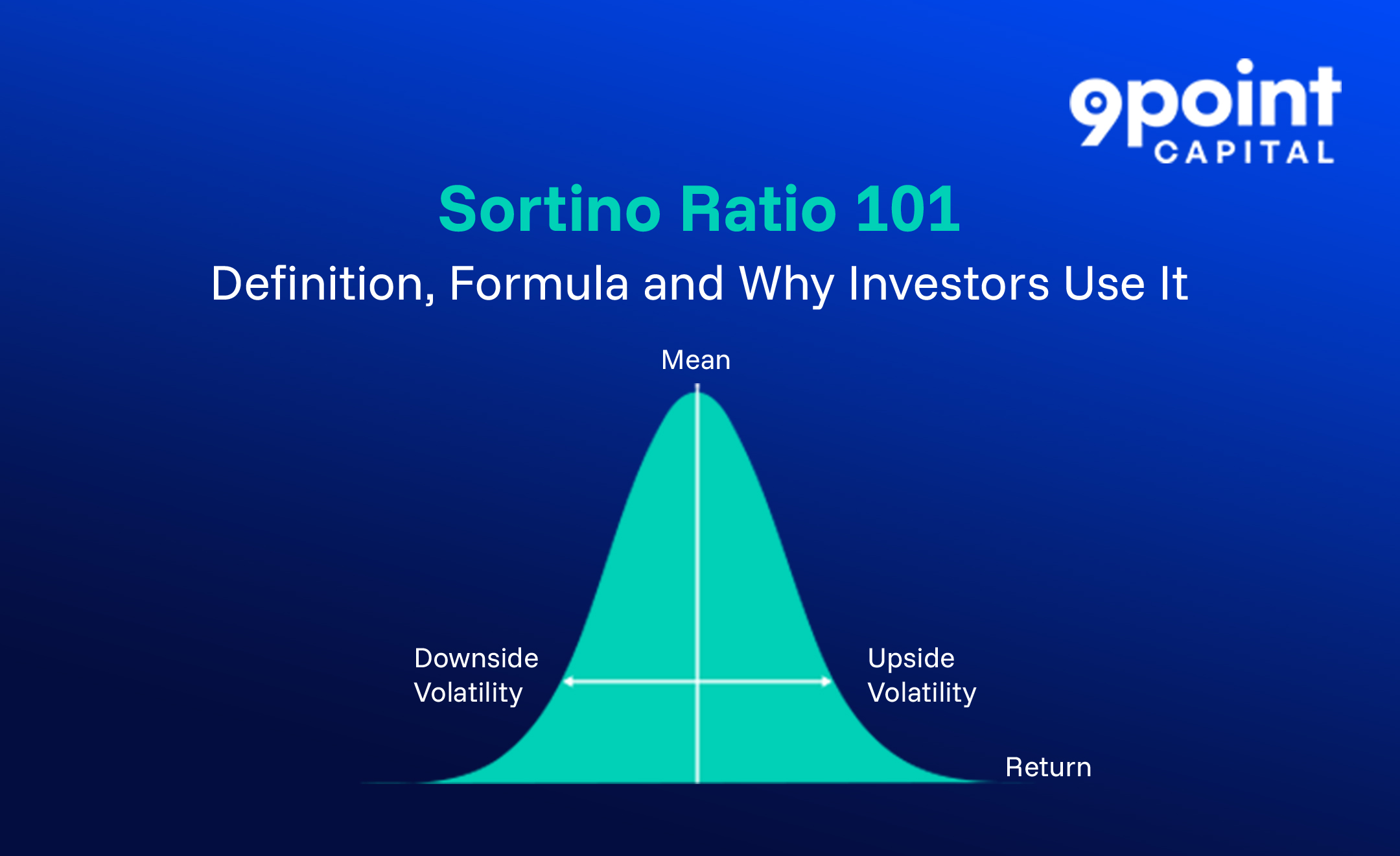

More stocks don’t always mean more safety. While diversification reduces individual stock risk, excessive diversification can dilute your conviction—and your returns.

Imagine a portfolio of 60 stocks. Even if a few outperform, the laggards can drag overall performance. And even if all perform well, you’re still exposed to systemic market risks and volatility correlations. Diversification improves the Sharpe Ratio only up to a point, then it flattens.

At 9Point Capital, we believe in thematic and sectoral diversification, not blind expansion. We build high-conviction, precision-weighted portfolios designed to capture long-term growth while actively managing downside risks.

Whether you’re investing in Bitcoin ETFs or other digital asset ETFs from India, global equities, or tokenised digital assets, our PMS investment approach is grounded in strategic focus, not scattergun allocation. That’s how we deliver safe investments with high returns in India while being risk-aware.

Tax-Efficient Investing: A Hidden Lever of Long-Term Growth

Smart portfolio management isn’t just about picking winners—it’s also about optimising what you keep after taxes.

In India, long-term capital gains (LTCG) on foreign equities are at a rate of 12.5%, while short-term gains are taxed at applicable income tax slab rates. That difference can compound meaningfully over time.

At 9Point Capital, we don’t just manage your portfolio—we manage your investment timelines with intent. By holding high-conviction assets strategically and planning exits thoughtfully, we help you minimise tax drag and maximise real returns.

Read more: How Indian Investors Can Profit From Digital Assets in 2025

Conclusion: Why a Long-Term Mindset Wins

Building wealth isn’t just about choosing the right assets—it’s about structuring your investments with foresight, discipline and strategy. At 9Point Capital, we believe long-term capital gains are the reward of thoughtful planning: quality digital asset and stock selection, patient capital, tax-aware decisions and consistent portfolio oversight.

You don’t need just another digital asset or PMS provider—you need a partner with the expertise, conviction and systems to turn your wealth into a long-term engine of growth. While markets may move, your portfolio can remain resilient, with smart structuring running quietly in the background.

If you’re looking for a digital asset-focused PMS in India that’s built for the future, not just for the now, your search ends here. Contact us now!

Let’s talk. Ask questions. Explore what’s possible.

At 9Point Capital, we don’t just manage portfolios. We structure enduring wealth.