Investing in digital assets like Bitcoin has become increasingly popular globally, including rising interest in Bitcoin ETFs in India.

What is Bitcoin ETF?

A Bitcoin ETF (Exchange-Traded Fund) allows you to invest in Bitcoin without having to buy and hold the cryptocurrency yourself. You don’t buy Bitcoin directly; instead, you buy a fund that trades on stock exchanges and follows the price of Bitcoin. This is great for people who want to invest in digital assets without having to deal with digital wallets or exchanges directly. It is safe, easy to use and convenient.

Bitcoin ETF in India

The interest in Bitcoin ETFs in India is growing due to the country’s increasing awareness and acceptance of digital assets. Indian investors see Bitcoin ETFs as a safe and regulated way, aligning perfectly with their traditional long-term investment strategies.

What is Tactical Asset Allocation?

Tactical asset allocation is a powerful investment strategy that changes the types of assets (stocks, bonds, Bitcoin ETFs, etc.) in your portfolio based on the market conditions. Tactical asset allocation lets you change your allocation in the short term to take advantage of market opportunities or manage risks. This is different from strategic asset allocation, which keeps a fixed allocation based on your long-term investment goals and risk tolerance.

Strategic vs. Tactical Asset Allocation

Strategic asset allocation involves setting fixed target percentages for your investments (stocks, bonds, Bitcoin ETFs) and regularly rebalancing to maintain this mix. Tactical asset allocation is more flexible, changing allocations based on market signals and trends to maintain risk-adjusted outperformance for the benchmark.

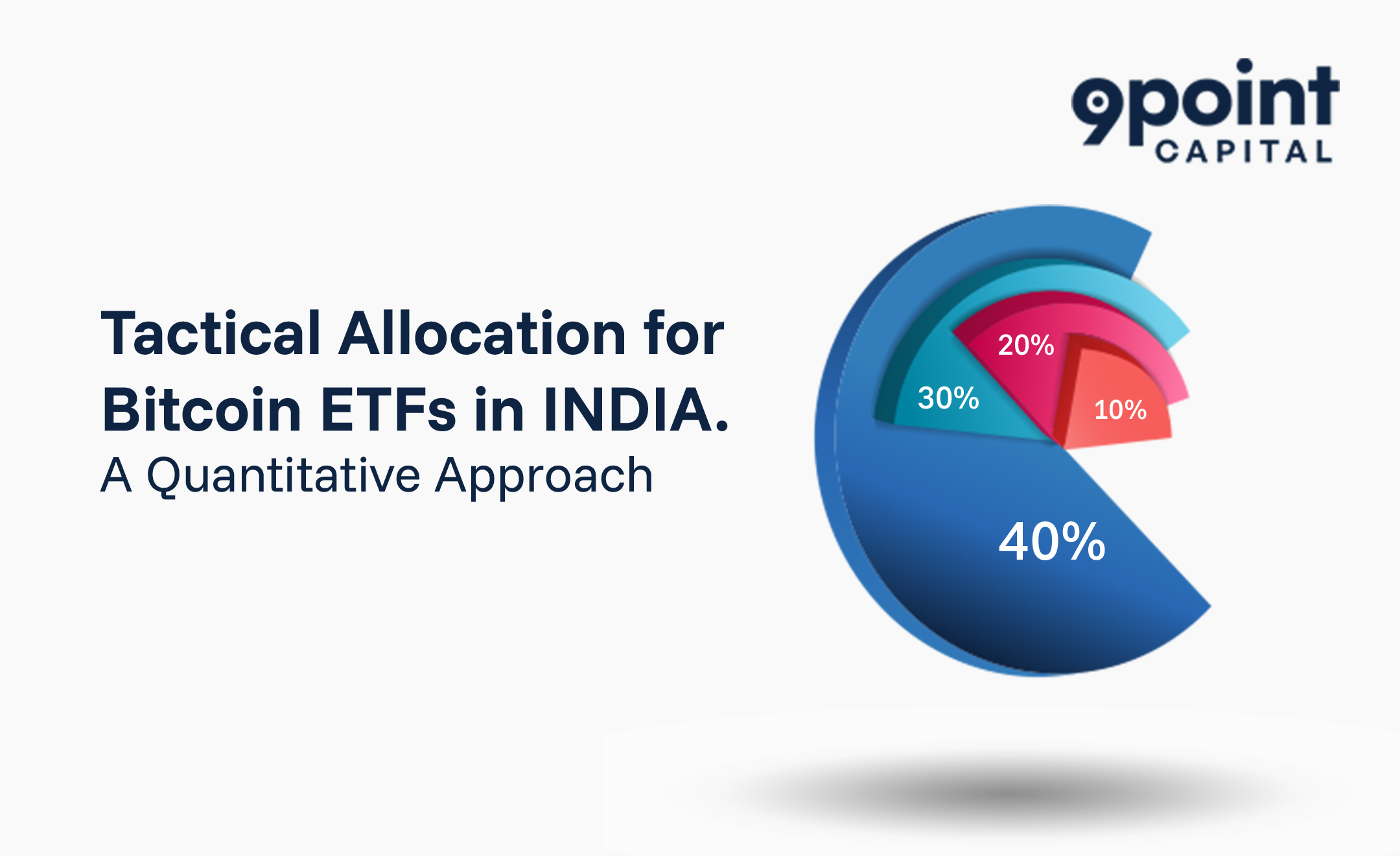

Tactical Allocation for Bitcoin ETFs in India

Using tactical allocation for Bitcoin ETFs means adjusting your investment based on market trends or volatility.

Simple Example of Tactical Allocation

Imagine your initial investment is:

- Stocks: 60%

- Bonds: 30%

- Bitcoin ETFs: 10%

If Bitcoin prices start rising sharply, you might adjust your portfolio:

- Stocks: 60%

- Bonds: 25%

- Bitcoin ETFs: 15%

If Bitcoin becomes volatile or risky, you might shift again to protect your money:

- Stocks: 60%

- Bonds: 35%

- Bitcoin ETFs: 5%

Quantitative Approach for Tactical Allocation

Let’s make this slightly technical, but still friendly.

Say you have a simple signal that tells you when Bitcoin is trending (like moving averages or volatility bands). When the signal is positive, you allocate more to Bitcoin ETFs. When it’s negative or flat, you reduce exposure.

For example:

- If BTC’s 30-day return > 10% and volatility < 50% → Increase ETF weight by +5%

- If BTC’s volatility > 70% and return < 0% → Reduce ETF weight by -5%

This system helps you stay objective and not overreact. It’s like using weather radar before sailing: you’re still going to the same destination, but you’re making smart changes to your sails.

Benefits of Long-term Investment

- Balance Growth & Safety: While Bitcoin is a high-growth asset, ETFs add a safety cushion. Tactical allocation lets you enjoy profit while managing risks.

- Stay Calm During Volatility: By adjusting only small portions of your portfolio, you stay invested but not overexposed.

- Better Risk-Adjusted Returns: You don’t chase returns blindly. You let the data guide you. This often leads to better Sharpe ratios and lower drawdowns over time.

In Summary

Tactical allocation isn’t about predicting the future, it’s about planning for it. For Indian investors eyeing Bitcoin but hesitant to go all in, Bitcoin ETFs + a tactical approach would be the perfect match. At the end of the day, it’s about staying invested, staying flexible and using logic over emotion.