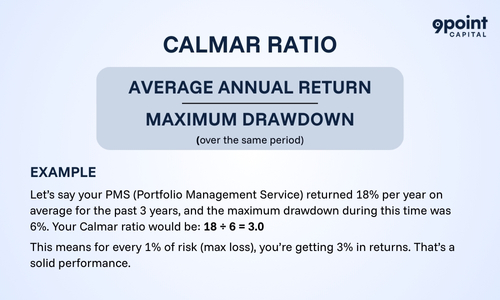

What is the Calmar Ratio?

The Calmar ratio (short for California Managed Accounts Report) is a way to measure the performance of an investment by comparing its average annual return to its worst recent drop, also called maximum drawdown.

In simple terms, it tells you: “How much reward am I getting for the risk I’m taking?”

- A higher Calmar ratio = better risk-adjusted performance.

- A lower Calmar ratio = more risk for less return.

This makes it an essential tool for comparing different investment strategies, especially if you’re investing in portfolio management services in India or globally.

How to Calculate Calmar Ratio?

Here is the formula:

What are Risk-Adjusted Returns?

It’s the return you get for each unit of risk you take. Tools like the Calmar measure help you see whether you’re being fairly compensated for the risk involved.

Why Risk-Adjusted Returns Matter?

Everyone loves high returns. But what if you had to endure a 50% drop just to get those gains? That’s not a good deal for most people. This is where risk-adjusted returns shine, they show whether an investment is truly worth it after accounting for the risk.

For example:

- Investment A returns 15% with a max drawdown of 5%.

- Investment B returns 20% with a max drawdown of 20%.

The Calmar ratio of A is 3.0 (15 ÷ 5), while B’s is 1.0 (20 ÷ 20). So even though B offers higher returns, A is much safer for each percent of return.

What is Maximum Drawdown?

Maximum drawdown represents the worst peak-to-trough decline in an investment’s value. It captures the potential losses an investor could have faced during difficult market conditions.

An investment with strong average returns but a deep drawdown may not be suitable for investors with low risk tolerance. The Calmar metric directly addresses this concern by including the maximum drawdown in its calculation.

Calmar Ratio vs Other Metrics

Other risk-adjusted return metrics include the Sharpe ratio, Sortino ratio, and RAROC (Risk-Adjusted Return on Capital). However, these often involve standard deviation or complex capital calculations.

What sets the Calmar ratio apart?

- Focuses solely on maximum drawdown, a realistic and intuitive measure of downside risk.

- Simple to compute and interpret.

- Especially useful for long-term performance evaluations.

While RAROC is more commonly used in banking and institutional finance, the Calmar metric is more relevant and accessible for individual investors and for evaluating portfolio management services in India.

Interpreting Calmar Ratio Values

Here is the overview of Calmar metrics:

| Calmar Ratio | Interpretation |

| Above 3.0 | Excellent risk-adjusted performance |

| 2.0 – 3.0 | Strong and balanced strategy |

| 1.0 – 2.0 | Moderate; review volatility |

| Below 1.0 | Weak; returns may not justify risk |

When evaluating an investment, especially if planning to invest in PMS, a Calmar ratio above 2.0 is generally considered a strong signal of a well-managed strategy.

Why Calmar Ratio Is Crucial for PMS Investors?

If you plan to invest in PMS, you’re likely looking for higher returns than traditional mutual funds. But these services can involve more aggressive strategies and higher risk. That’s why evaluating a PMS provider’s Calmar is key. It tells you whether their impressive returns come at the cost of stomach-churning volatility or whether they deliver true, stable value.

So before you sign up, ask:

- What’s the Calmar ratio of this PMS strategy?

- How did it perform in tough market years?

Summary: Smart Investing for Modern Investors

If you’re serious about growing your wealth without losing sleep, the Calmar indicator should be part of your investing toolkit. Whether you’re considering hedge funds, alternative assets, or portfolio management services in India, understanding risk-adjusted returns is non-negotiable.

It helps you:

- Compare investments wisely

- Avoid hidden risks

- Choose better-performing strategies over time

So next time you’re evaluating where to invest your money, don’t just ask “What’s the return?” — ask “What’s the Calmar ratio?”

Read more for expert investor guidance and actionable insights.