What is CAGR?

CAGR stands for Compound Annual Growth Rate. It tells you how much your investment has grown on average per year over a certain period.

Think of it like this: If your investment grew steadily each year and reached a certain amount at the end, CAGR is the rate it would need to grow every year to get there.

How to Calculate Compound Annual Growth Rate:

Practical Example:

Suppose you invested $1,000, and after 5 years, your investment grows to $1,500. Your CAGR would be:

What is Volatility?

Volatility shows how much an investment’s price goes up and down over time.

- High volatility = Big swings

- Low volatility = Small changes

It tells you how smooth or shaky your investment ride will be.

Importance of Understanding CAGR vs. Volatility

Clearly understanding CAGR vs. Volatility helps investors evaluate long-term growth prospects and the risks associated with achieving this growth. A careful balance between these two metrics is crucial for aligning your investments with your risk tolerance and financial objectives.

Balancing CAGR vs. Volatility for Optimal Investment

- CAGR provides a clear understanding of expected returns over the long term, essential for financial planning and goal-setting.

- Volatility highlights the stability or instability of your investment journey. High volatility can potentially deliver higher returns but also introduces significant risk and emotional stress.

Example Scenario:

- Investment A: 25% CAGR, High volatility.

- Investment B: 8% CAGR, Low volatility.

Investment A might attract aggressive investors willing to accept risk for higher returns, whereas Investment B could appeal to conservative investors seeking stable and predictable outcomes.

How Investors Can Apply This Knowledge

- Risk Assessment: Determine your comfort level with fluctuations associated with high-volatility investments.

- Strategic Planning: Choose investments whose CAGR aligns with your financial goals, such as retirement, education funding, or wealth accumulation.

CAGR vs Volatility: Why Bitcoin Might Just Be Worth It

Imagine you’re planning a road trip.

You have two choices:

- Route A is super smooth — no bumps, but slow.

- Route B is a rollercoaster — lots of bumps, sharp turns, but you get to your destination way faster.

Most people naturally prefer Route A because it feels safer. But what if I told you Route B, despite being bumpy, gets you to a much bigger, better destination?

In investing, CAGR and Volatility are exactly like these two roads.

- CAGR (Compound Annual Growth Rate) is how much your investment grows every year on average. It’s the final destination.

- Volatility is how bumpy the ride is — how much the price swings up and down along the way.

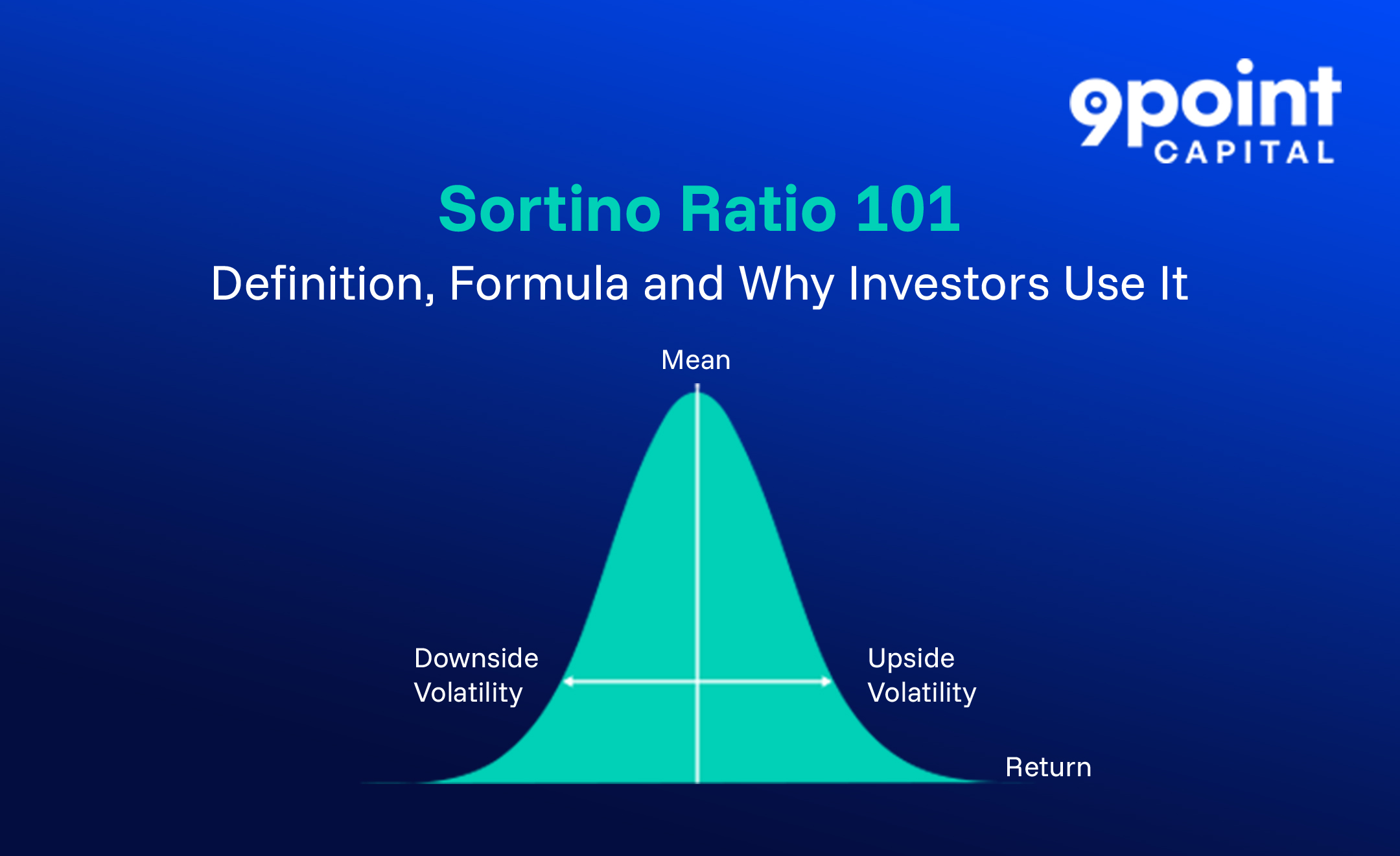

Understanding Volatility: Bitcoin vs. Traditional Assets

Here is the comparison:

- Bitcoin (BTC) has a CAGR of 73.71%, which is high.

- NIFTY, India’s top 50 stocks, grows around 10.74% annually.

- The S&P 500 (top US stocks) gives 10.05%.

- Gold grows at 10.38%.

Bitcoin’s volatility is 57.22%, which is significantly higher than NIFTY at 16.59% and Gold at 14.87%. This makes Bitcoin a much more unpredictable investment.

However, higher volatility does not always mean lower returns. Historically, Bitcoin has outperformed traditional assets for those who remained invested over time.

Key takeaway:

Volatility is part of the investment journey. It should be understood and managed, not feared. Long-term discipline often matters more than short-term market movements.

Lesson:

Do not let short-term fluctuations shake your confidence. Focus on the long-term goal. Staying invested can lead to better outcomes than reacting to every bump along the way.

Concluding thoughts

Investors typically favour a higher CAGR due to its indication of solid long-term growth. However, growth alone is insufficient. The journey may be challenging if volatility is significant.

This is why it is crucial to concentrate on risk-adjusted returns, which involve identifying investments that provide strong growth while simultaneously managing the fluctuations.

In summary, comprehending both CAGR and volatility is instrumental in ensuring that you make informed decisions and remain on the path to long-term compounding.

Explore more articles to learn how to invest in Bitcoin ETFs and gain a better understanding of digital assets.