Let’s break down what the Sortino ratio is, how it’s calculated and why it matters. This is especially important if you’re planning to invest in PMS or evaluating portfolio management services in India.

What Is the Sortino Ratio?

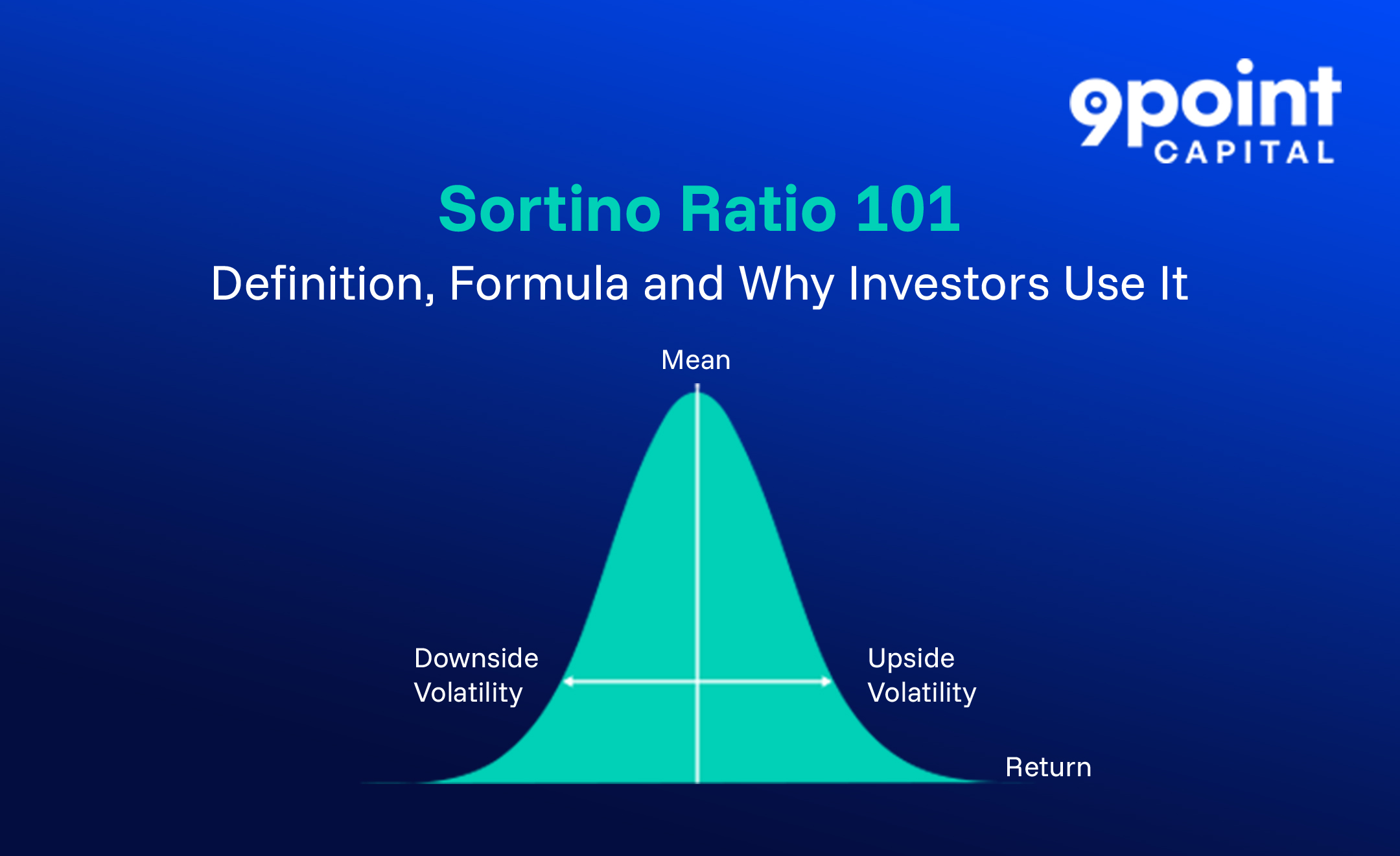

The Sortino ratio is a risk-adjusted performance measure that indicates how much return an investment generates for every unit of downside risk.

Unlike the Sharpe ratio, which treats all volatility as detrimental, the Sortino ratio focuses solely on negative returns, the kind that harm your portfolio. It doesn’t penalise you for strong performance or upward momentum.

In simple terms, the Sortino ratio helps you judge how efficiently an investment earns profits without exposing you to large losses.

If you’re exploring portfolio management services in India, this metric helps you filter between managers who simply chase returns and those who manage risk prudently.

Why Investors Use the Sortino Ratio

1. Focuses on Downside Risk Only: It ignores volatility caused by gains and only considers periods where your returns fall below a threshold, usually the risk-free rate.

2. Ideal for PMS and Wealth Management: When you invest in PMS, you’re often trusting a manager with large sums. You want high returns, but with controlled downside risk. Sortino tells you how well the manager is achieving that.

3. Better Comparison Tool: Two funds may show the same returns, but the one with fewer deep drawdowns will have a higher Sortino. That makes it a safer choice.

How to Calculate Sortino Ratio

Here’s the official formula:

Sortino Ratio = (Average Return – Risk-Free Rate) ÷ Downside Deviation

Let’s break it down:

- Average Return: The annualised average return of your portfolio or investment

- Risk-Free Rate: Typically, the return on a government bond (e.g., 6% in India)

- Downside Deviation: The standard deviation of negative returns only, i.e., how much your portfolio fell below the risk-free rate

Example: How to Calculate Sortino Ratio

Let’s say you invest ₹50 lakhs in a PMS. Here’s the data:

- Average Annual Return: 15%

- Risk-Free Rate: 6%

- Downside Deviation: 4%

Now plug it into the formula:

Sortino Ratio = (15 – 6) ÷ 4 = 9 ÷ 4 = 2.25

Interpretation:

A Sortino ratio of 2.25 means your portfolio is earning 2.25 units of return for every unit of downside risk. That’s a strong performance. Most professionals consider anything above 2 as excellent.

Sortino Ratio vs. Sharpe Ratio

Here the general differences between sortino and sharpe ratios:

| Feature | Sharpe Ratio | Sortino Ratio |

| Measures | Total volatility (up and down) | Only downside volatility |

| Penalises | Both gains and losses | Only losses |

| Ideal For | Broad comparison | Downside risk analysis |

| Use in PMS? | General overview | More accurate for risk protection |

If your goal is capital protection along with growth, especially relevant when you invest in PMS, the Sortino is more useful than the Sharpe.

When Should You Use the Sortino Ratio?

- Comparing multiple PMS strategies that claim similar returns

- Evaluating mutual funds, ETFs, or alternative investments

- Selecting stable portfolios with a long-term horizon

- When your investment objective prioritises wealth preservation

If you’re considering high-ticket portfolio management services in India, ask about their Sortino ratio to evaluate how well they manage downside risk.

Limitations to Keep in Mind

- Requires historical data to compute accurately

- Doesn’t penalise erratic positive returns, which could be risky for some investors

- Assumes the risk-free rate is constant, which may not always be true

Still, when used properly, the Sortino offers a clearer, more practical picture of investment quality.

Summing Up

In the world of investing, returns without context can be misleading. The Sortino ratio gives you a sharper lens to evaluate:

- Is the portfolio growing your wealth?

- Is it doing so without exposing you to large risks?

So the next time a manager promises double-digit returns, go one step further and ask:

“What is the Sortino ratio of this strategy and how do you manage downside risk?”

Because in the long run, it’s not just about how high your portfolio climbs, but how well it avoids the fall.

Looking to invest in PMS with strong downside protection?

Understanding the Sortino ratio is your first step. Choosing the right partner to apply to is the next step. 9Point Capital helps you compare options, decode manager strategies and build a portfolio that works for you, not against you.

Read for more expert investor guidance and actionable insights: